With TriFact365 it is possible to process invoices with VAT reverse charge. Depending on the accounting software you work with, additional settings are required in TriFact365.

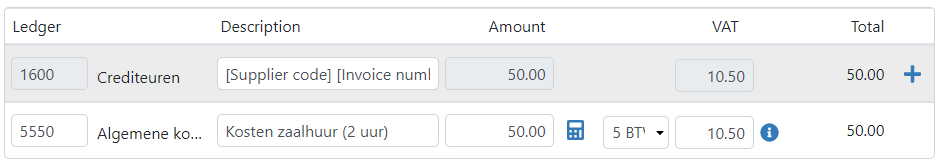

In the check screen, the VAT amount will automatically not be added to the total amount, if you select a VAT code that is marked as Reverse Charged. In addition, the blue info-icon shows that the VAT is Reverse Charged.

AccountView, AFAS, Exact Online, iMUIS Online SnelStart, Visma eAccounting

No additional settings are required. TriFact365 automatically registers, based on the VAT code, whether the VAT must be reverse charged.

King Anywhere, King Business Software, Twinfield

- In TriFact365, go to Settings (cogwheel) > Administrations > Three dots > Edit > VAT codes

- Check Reverse Charged for the relevant VAT codes

Unit4 Multivers / Boekhoud Gemak

For Unit4 Multivers, no additional settings are required in TriFact365. You do need to select the correct VAT scenario for the relation in the Check screen. The VAT scenario determines whether the VAT must be reverse charged.